The China Ministry of Finance recently announced a significant revision of customs duty regulations for import shipments into China through major ports & airports.

Under the previous regulations, customs duties for foreign passport holders processing a first import of a 20’ft container could range from USD 2000 to USD 6000, sometimes, the fee for customs duties & taxes was more than the total shipping cost, double the value of the goods in some cases.

This new regulation is a good news for those who are planning to relocate to China as this is expected to significantly lower the cost of international shipments into China.

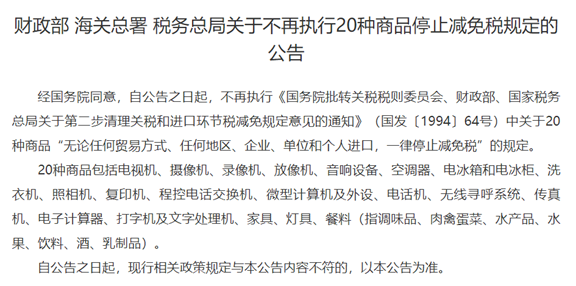

Regulation with announcement No. A05920200038, which replaces the previous regulation implemented since 1994, specifies 20 categories of goods that are no longer subject to customs duties.

These 20 categories include:

- Televisions

- Video cameras

- VCRs

- Video players

- Audio equipment

- Air conditioners

- Refrigerators and freezers

- Washing machines

- Cameras

- Copiers

- Program-controlled telephone switches

- Microcomputers and peripherals

- Telephones

- Wireless paging systems

- Fax machines

- Electronic calculators

- Typewriters and word processing machines

- Furniture

- Lamps

- Foodstuffs including spices, meat and dairy products, aquatic products, fruits, beverages, alcohol etc.

The new regulation does not apply specifically to import of household goods. What’s more, as is usual in China, its implementation may vary from province to province based upon the interpretation of each provincial customs authority.

Below is a summary of how this new regulation is currently being implemented across the country.

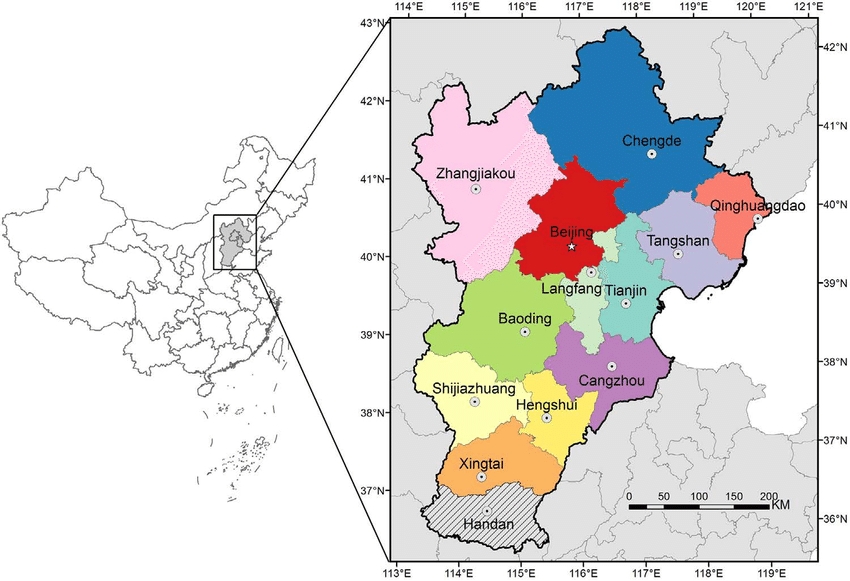

Beijing and Tianjin

The duty-free policy for 20 types of goods imported by foreigners with long-term residence permits is being implemented. However, there is currently noinformation about when it will actually come into force.

- Foreigners with long-term residence permits can import the 20 types of goods listed above duty-free. However, any single item with a value above CNY5000 is subject to customs duty. Up to 15 golf clubs can be imported duty-free; clubs in excess of that number will be subject to duty. Pianos valued at more than CNY5000 are subject to duty.

- Foreigners with short-term visas are subject to full tax.

- Chinese citizens returning to China will pay duty on single items with a value over CNY 1,000. Up to 10 books and 20 CDS and DVDS are exempt from duty & tax.

- Foodstuffs are still subject to quarantine inspection.

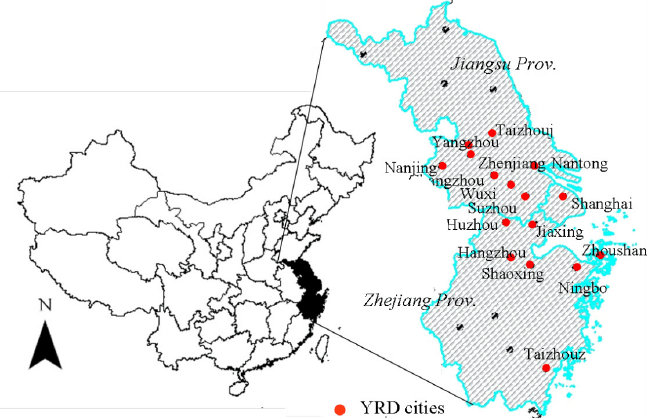

Yantze River Delta Region (including Shanghai & Nanjing)

The latest Shanghai regulations concerning the duty-free import of personal effects are as follows:

Foreigners:

- Permanent residents and non-residents with long-term residence permits are exempt from tax on their first-time import shipment to China.

- First-time importers are defined as importers who are applying for a Chinese import permit for the first time.

- The above 20 categories of goods are duty free provided the shipment is the applicant’s first entry into China and the quantities are deemed reasonable.

- From the second shipment onwards, shipments will be dutiable as before.

- Foodstuffs remain subject to quarantine inspection and authorization.

- Items exceeding a reasonable amount for self-use shall be returned to the country of origin or abandoned, except where the “reasonable amount” can be proved with relevant documents such as family document (residence permit is a must).

For the time being, a reasonable quantity of goods is defined as follows:

- Books- 700 (max. 1500 books are allowed to be imported)

- Audio and video products(CD,MD, CD, tape, etc.)- 300 pieces

- Visual speaker products(DVD, videotape, etc.) -200 pieces,

- Golf clubs- 26

- Milk powder- 6 kilograms

- Alcohol: 2 bottles duty-free, 2 bottles subjected to duty, max.4 bottles allowed

- Upright pianos are exempt from customs duty in Shanghai, baby grand pianos cannot be imported.

The Shanghai customs regulations apply to personal effects imported into the Yangtze River Delta, including Wuxi, Suzhou, Kunshan, Ningbo, Nanjing etc.

Unfortunately, for Chinese returning to places listed above, duty & tax still applies as in the previous regulations.

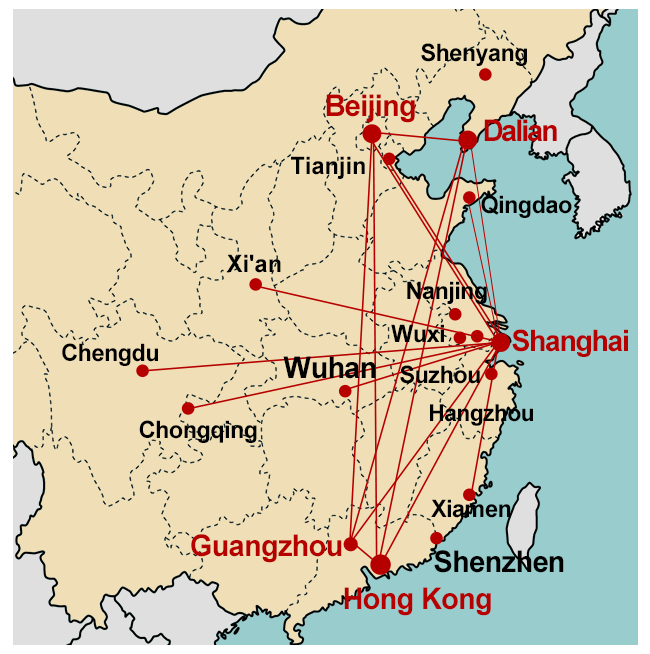

PRD (Pearl River Delta) Region Including Guangzhou, Shenzhen, etc.

At present, Guangzhou Customs will not impose any tax on the first shipment of permanent residents, non-resident with long-term residence permits, provided that goods imported do not exceed a reasonable self-use amount. The power of interpretation lies with the Customs. Up to 13 golf clubs can be imported. There is no specific requirement on the quantity of books, CDS etc. that can be imported.

Returning Chinese still have to pay duty & tax for import shipments into this area.

Other Cities, Including Dalian, Chengdu, Wuhan

Customs authorities in these cities have not yet released information on how the new regulation will be implemented.

Please note that the implementation of the new regulation will likely evolve over time and across provinces, with implementation issues in certain cities. What’s more, some customs officers may still consider that customs duties are payable. Nevertheless, the regulation is welcome news because it will considerably lower the cost of relocations into China.

For more details please click the link to official Ministry of Finance announcement (In Chinese only):

Disclaimer:

Implementation of customs regulations in China can vary widely across regions and can change at any time without notice. The above is for information purposes only and CIM Mover cannot be held liable.